All About Friktion - Implementing Volt Strategies!

Learn about utilizing Friktion's Volt strategies to generate risk-managed returns in any macroeconomic conditions

The goal of any investor is to outperform the markets - cyclicality and changes in outlooks makes this goal ever more difficult within these uncertain times. A diversified portfolio is of the utmost importance, and I’ve recently been looking at additional quantitative strategies to diversify and capture yield in the DeFi space. One such outlet that has caught my eye is Friktion and their Volt strategies.

Friktion is a Solana-based DeFi protocol that aims to provide users with a variety of risk-managed return generation strategies, known as Volts. Using Volts, users are able to access a number of different quantitative investment strategies that make use of financial derivatives to capture yield across market cycles. Let’s dive into each of the five Volts that are currently offered on Friktion and how you can use each to compliment your portfolio!

Before we take a look into each distinct Volt, we need to understand - who benefits from such strategies? Is this geared towards sophisticated users, DeFi newbies, or both?

Well, the answer is simple - Volts are geared towards any and all users - but it is important to understand how they work and how to implement them with your own personal investment standards.

For passive investors and liquidity providers, Volts provide a system of automated portfolio management so that you can implement strategies to hedge against market downturns or react to any macroeconomic conditions. For more active traders, making use of optionality through a variety of different strategies allows you to access leverage in DeFi markets and capture mispricings between assets and their volatilities. In addition, Volts are accessible to DAOs and other protocol treasuries for Custom Liquidity Mining and implementing asset-preservation strategies.

But now - let’s dive into each Volt and learn about different strategies!

Volt #1 - Generate Income

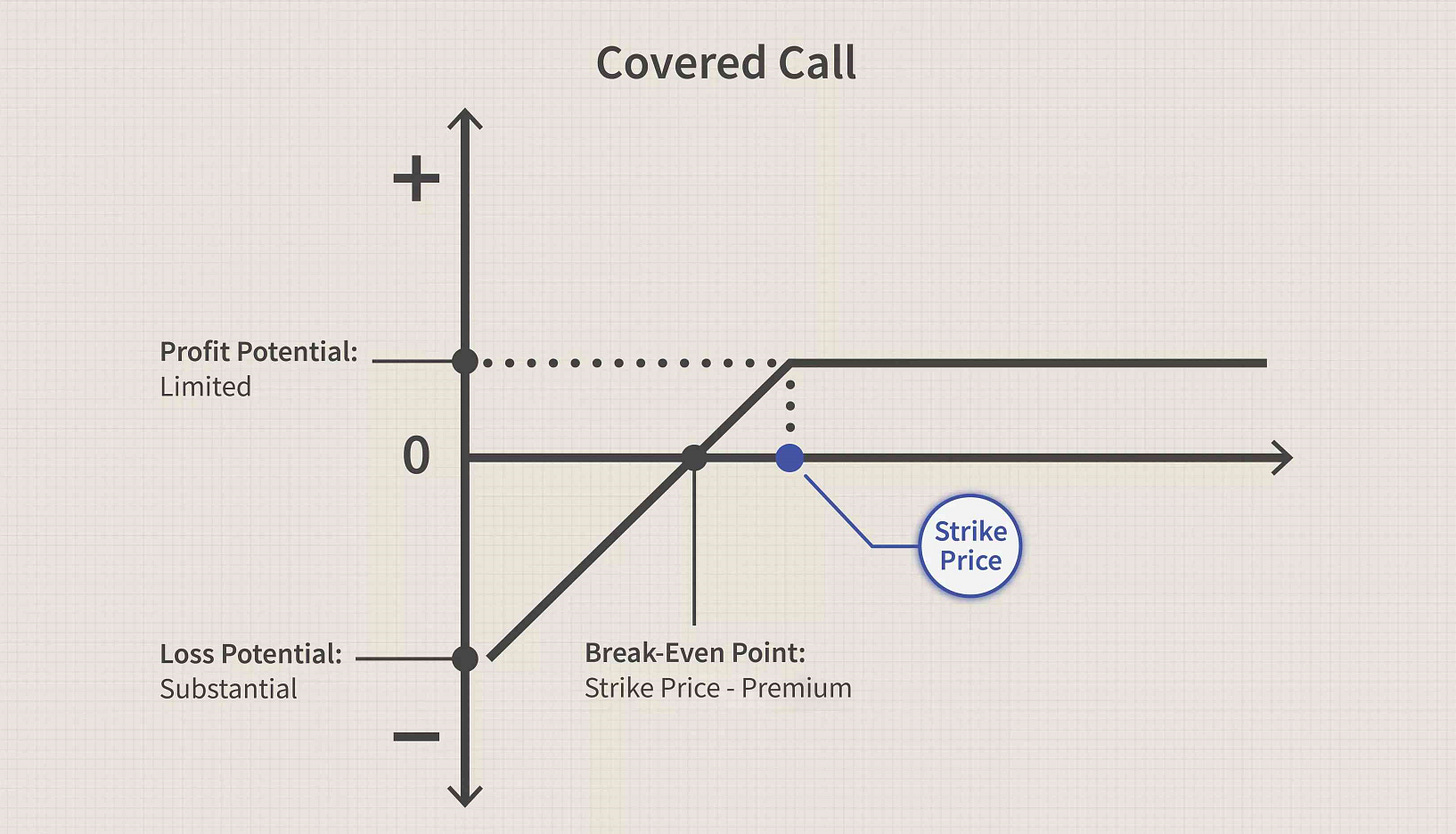

Volt #1 generates income by running an automated covered call strategy and collecting the option premium. This strategy involves holding a long position in a particular asset and writing a call option on that same asset with the goal of realizing additional income from the option premium - this is known as a covered call. When you sell a covered call, you profit from high upside volatility and generate a premium on top of your long position while markets are moving in a range-bound position.

When executing a covered call strategy, the most optimal situation is for the underlying price of the asset to not move much before expiration, or stay in a range-bound position. This is because you gain a premium on selling the call as well as maintain upside to your own long position - however, if the price of the underlying asset hits a certain strike price, the party on the other side is able to exercise the option and you will have to sell the underlying asset to them

This same situation applies to Volt #1 - the risk involved here is that if the price of the underlying asset goes above the call option’s strike price at expiration and the options are in-the-money, the Volt may incur a loss.

Volt #1 is perfect for a macroeconomic environment that has some upside volatility but remains range-bound. You could play Volt #1 by entering and exiting at various times for periodic premiums, when markets are in a lull or you have expectations of them staying range-bound.

When considering event-based strategies, market conditions for Volt #1 could be favorable when there are no significant economic data announcements or Federal Reserve meetings i.e. FOMC meetings, CPI/PCE data reports, unemployment figure releases, etc.

Considerations going forward for range-bound/mildly-bullish sentiment include a weakening dollar ($DXY), low volatility in US bond yields, VIX staying range-bound, etc. It is also important to consider events like FOMC meetings and CPI data reports, as potential rate hikes and data that strays far from expectations may cause increased volatility. Since we are selling a call, we don’t want too much upside potential in equities and risk assets, so your outlook should be fairly neutral.

Friktion currently offers Volt #1 for about 15 different assets, each with varying degrees of price volatility and risk, so be sure to perform proper due diligence.

Volt #2 - Sustainable Stables

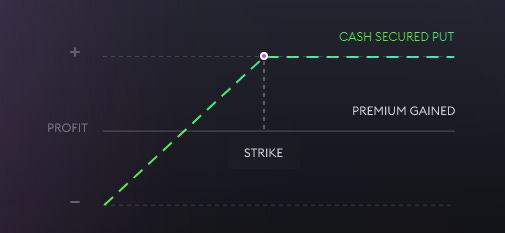

Volt #2 generates returns on stablecoins by running an automated cash-secured put strategy. A cash-secured put has a payout profile similar to that of a covered call - investors sell a put option while maintaining enough cash to purchase the underlying asset at a predetermined strike price. This means you are essentially maintaining a 100% collateral ratio, making this Volt relatively low-risk.

The cash-secured put is a strategy made of two parts- selling an out-of-the-money put while also having enough cash to purchase the underlying given it hits the option strike price. By selling the cash-secured put, you collect the premium from the option buyer while also maintaining the prospect of acquiring the underlying asset at a lower price than the market price in the future.

Volt #2 profits if the price of the underlying asset does not fall below the given strike price - this means that during extreme downward market moves, you could lose your principal.

Volt #2 is geared towards a low volatility, bullish market - the goal here is for the option not to get exercised so that you have no loss of principal while also keeping the option premium.

This strategy bodes well when sentiment is positive and there are favorable macroeconomic conditions. Currently, for risk assets like cryptocurrencies and equities, favorable developments include a weakening of the dollar ($DXY), dovish sentiment from the Fed going forward given a softer CPI/PCE print (50 bps hike, or lower, with the prospect of a potential pivot), and improvements in overall market conditions. Acceleration and net easing in terms of monetary policy and macro is what we want to see to maintain long-term comfortability in Volt #2.

This strategy should be avoided if sentiment is poor and volatility begins to spike in anticipation of a market crash or some sort of black-swan event that could cause extreme downward movement. Given current developments in Russia/Ukraine, recent news about Credit Suisse, and other bearish reports, it is always important to consider that edge cases may occur and to always hedge your bets.

Volt #2 is currently offered for 7 different positions - interestingly, native SOL is the underlying in 4 of the vaults.

Volt #3 - Crab Strategy

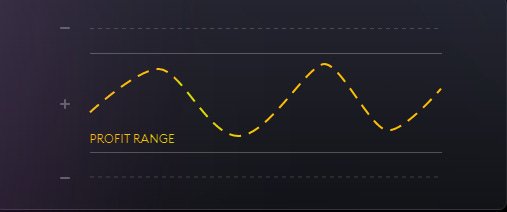

Volt #3 implements a bit more complicated of a strategy - in essence, this Volt runs a delta-neutral volatility harvesting strategy. This Volt earns funding payments by putting on a short Power Perpetual position which collects funding rate premiums while hedging directional price risk with normal perps. This means that the Volt generates a yield by capturing volatility, rather than betting on a directional price move. This strategy is similar to that of selling an at-the-money straddle to short volatility. To learn more about Power Perpetuals, check out Friktion’s ELI5 here.

This strategy maintains a +EV when the price of the underlying asset (BTC) stays range-bound in a specific “Profit Range”. According to Friktion Analytics, the strategy currently becomes unprofitable if BTC moves more than +/- 12.1% within a given epoch (weekly rebalancing).

Because you are short volatility, following this strategy means that you want markets to stay in a tight, range-bound territory. Though quite different in execution, the conditions for profit are a bit similar to that of Volt #1 - we would want a neutral sentiment towards markets, including stability in bond prices/yields, range-bound movements in VIX, minimal fluctuations in the dollar ($DXY), and economic figures that are in-line with expectations. Positive movements in equities or other risk assets would mean a greater risk in the strategy becoming unfavorable, as funding rates could significantly flip positive/negative and it becomes difficult to profitably delta-hedge. Likewise, significant bearish movements due to a rise in US bond yields, significant rate hikes, and other tightening conditions could bode poorly for the strategy.

Volt #4 - Basis Yield

Volt #4 runs a delta-neutral automated basis trading strategy to generate returns. A delta-neutral strategy is one that utilizes multiple positions with balancing positive and negative deltas so that the overall delta is zero, allowing you to collect funding premiums. Volt #4 works by specifically depositing USDC into Mango Markets, a decentralized perpetuals exchange on Solana, entering a long position in SOL-PERP while simultaneously maintaining a short position on SOL.

This allows users to generate yield by collecting continuous funding payments on Mango during times of negative funding, when perps are trading below the spot price. The risk here is that positive funding positive rates may occur, which may lead to negative returns. Delta exposure is thus possible if an imperfect hedge occurs during rebalancing slippage.

Volt #4’s returns are best when there are negative funding rate environments. This means that there are intrinsically more short positions open than long, so those with open short positions are paying those that are long to tighten the gap between perp/spot prices. Volt #4 focuses on specifically SOL-based positions, and most recently, there has been a structural short basis regime on SOL.

In terms of positioning Volt #4 within your own trading strategy, is it important to note how traders view future movements in the price of SOL and if there is a short basis regime present, and expected, for the foreseeable future. This would involve generally negative, bearish sentiment and would be in line with several macroeconomic factors that affect cryptocurrency and other risk assets, like a strengthening dollar, falling bond prices/higher bond yields, and further monetary tightening. However, we would want implied volatility to be generally low, as large swings could make funding rates flip or tighten quickly given some short-term, unexpected market conditions.

Volt #5 - Capital Protection

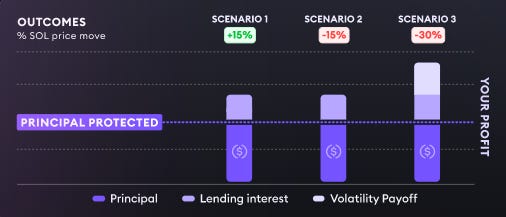

Volt #5 is quite interesting in design. Essentially, by entering this strategy, you earn interest revenue from lending to hedge against a drastic drop in the price of SOL. As a result, you get 100% principal protection and are also long volatility.

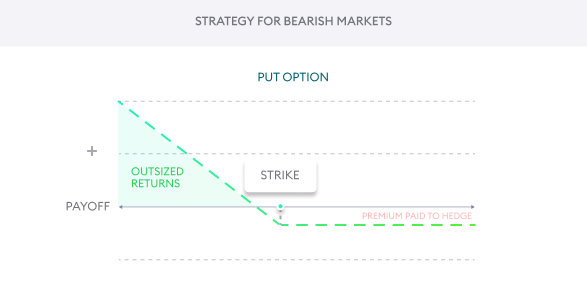

The Volt works by lending out deposits onto Tulip, a Solana-based yield aggregation protocol, to earn interest yield through optimizing and rebalancing positions on a number of different overcollateralized lending platforms. Thus, you are earning yield on a stablecoin with no price exposure. Additionally, a portion of the interest gained is used to purchase SOL puts, which hedges against a fall in the price of SOL.

This means that only your interest yield has exposure to SOL - interestingly, this also opens additional yield opportunities - since you are opening a put, you can earn outsized returns from the put when the price of SOL drops by more than the price hedge (i.e. 25%). When the price of SOL falls below the strike price, the put option is in-the-money, and the Volt #5 depositor has the right to sell SOL at the strike price and earn a profit.

This particular strategy earns returns with principal protection, as the only price exposure you have is through purchased SOL puts from accrued interest yield. Volt #5 depositors benefit most when there is a bearish sentiment towards SOL and other cryptocurrencies, which would come with a macro view of tightening monetary policy. Favorable conditions for positive returns on this Volt include a strengthening of the dollar ($DXY), rising US bond yields, increased volatility, and generally any economic data that points to increased hawkish sentiment from the Fed and other central banks. Falling equity prices bode well for SOL puts, as there have been consistent correlations between large-cap cryptocurrencies and traditional equities despite some de-coupling.

For those looking to diversify their crypto investment portfolio and implement a variety of strategies to play the macro, Friktion’s Volts are an interesting and effective tool for doing just that. The most important risk management strategy for any DeFi user is to always perform proper due diligence and to dive into how your favorite protocols and vaults work, and then making a calculated play based on how you see future events and macroeconomic conditions playing out.

Be sure to follow me @web3entropy on Twitter and check out Friktion for yourself :)